The Only Guide to The Wallace Insurance Agency

Table of ContentsAll about The Wallace Insurance AgencyWhat Does The Wallace Insurance Agency Do?The Definitive Guide to The Wallace Insurance AgencyNot known Facts About The Wallace Insurance AgencyThe Only Guide to The Wallace Insurance AgencyThe Best Strategy To Use For The Wallace Insurance AgencyGetting My The Wallace Insurance Agency To WorkThe Wallace Insurance Agency Fundamentals Explained

These strategies also provide some protection component, to assist guarantee that your beneficiary obtains financial settlement ought to the unfavorable occur throughout the tenure of the policy. Where should you start? The easiest way is to start thinking regarding your priorities and demands in life. Right here are some inquiries to get you began: Are you looking for higher hospitalisation protection? Are you focused on your household's health? Are you trying to conserve a nice sum for your youngster's education requirements? Lots of people begin with among these:: Against a history of climbing medical and hospitalisation costs, you may desire bigger, and greater coverage for medical expenses.: This is for the times when you're hurt. As an example, ankle sprains, back sprains, or if you're knocked down by a rogue e-scooter motorcyclist. There are also kid-specific policies that cover play ground injuries and conditions such as Hand, Foot and Mouth Disease (HFMD).: Whole Life insurance policy covers you for life, or usually up to age 99. https://codepen.io/wallaceagency1/pen/gOqGYar.

The 9-Minute Rule for The Wallace Insurance Agency

Relying on your protection strategy, you obtain a lump amount pay-out if you are permanently disabled or seriously ill, or your loved ones get it if you pass away.: Term insurance gives protection for a pre-set time period, e - Affordable insurance. g. 10, 15, two decades. Due to the much shorter protection duration and the absence of cash money worth, premiums are typically reduced than life strategies

When it matures, you will obtain a round figure pay-out. Money for your retirement or youngsters's education, check. There are 4 common kinds of endowment plans:: A strategy that lasts concerning one decade, and provides yearly cash advantages on top of a lump-sum quantity when it matures. It commonly consists of insurance policy protection versus Total and Permanent Impairment, and death.

The Wallace Insurance Agency - The Facts

You can choose to time the payout at the age when your youngster goes to university.: This provides you with a month-to-month income when you retire, generally on top of insurance policy coverage.: This is a method of saving for temporary objectives or to make your money work harder versus the forces of inflation.

7 Simple Techniques For The Wallace Insurance Agency

While getting different policies will certainly offer you a lot more thorough coverage, being excessively protected isn't an advantage either. To stay clear of undesirable monetary stress, compare the policies that you have against this checklist (Auto insurance). And if you're still not sure regarding what you'll need, how a lot, or the kind of insurance policy to get, speak with a monetary consultant

Insurance policy is a long-lasting dedication. Constantly be prudent when selecting a plan, as switching or ending a strategy prematurely typically does not yield economic advantages. Conversation with our Wealth Preparation Supervisor currently (This conversation solution is readily available from 9am to 6pm on Mon to Fri, excluding Public Holidays.) You might also leave your contact details and we will get in touch quickly.

The Facts About The Wallace Insurance Agency Revealed

The ideal component is, it's fuss-free we automatically work out your cash flows and supply cash suggestions. This article is indicated for information just and must not be trusted as financial guidance. Before making any choice to get, offer or hold any financial investment or insurance item, you ought to inquire from a financial consultant regarding its suitability.

Spend just if you comprehend and can check your financial investment. Diversify your investments and prevent investing a big portion of your cash in a solitary product issuer.

Fascination About The Wallace Insurance Agency

Life insurance policy is not always one of the most comfortable based on review. Yet much like home and auto insurance, life insurance coverage is necessary to you and your family members's monetary her latest blog security. Parents and functioning adults typically need a type of life insurance policy plan. To help, let's check out life insurance policy in much more information, how it works, what worth it might supply to you, and exactly how Bank Midwest can assist you discover the best policy.

It will help your household settle financial debt, obtain income, and get to major financial goals (like university tuition) in case you're not right here. A life insurance policy is essential to planning these monetary factors to consider. For paying a monthly costs, you can obtain a set amount of insurance policy coverage.

About The Wallace Insurance Agency

Life insurance is ideal for virtually everyone, even if you're young. People in their 20s, 30s and also 40s often overlook life insurance coverage.

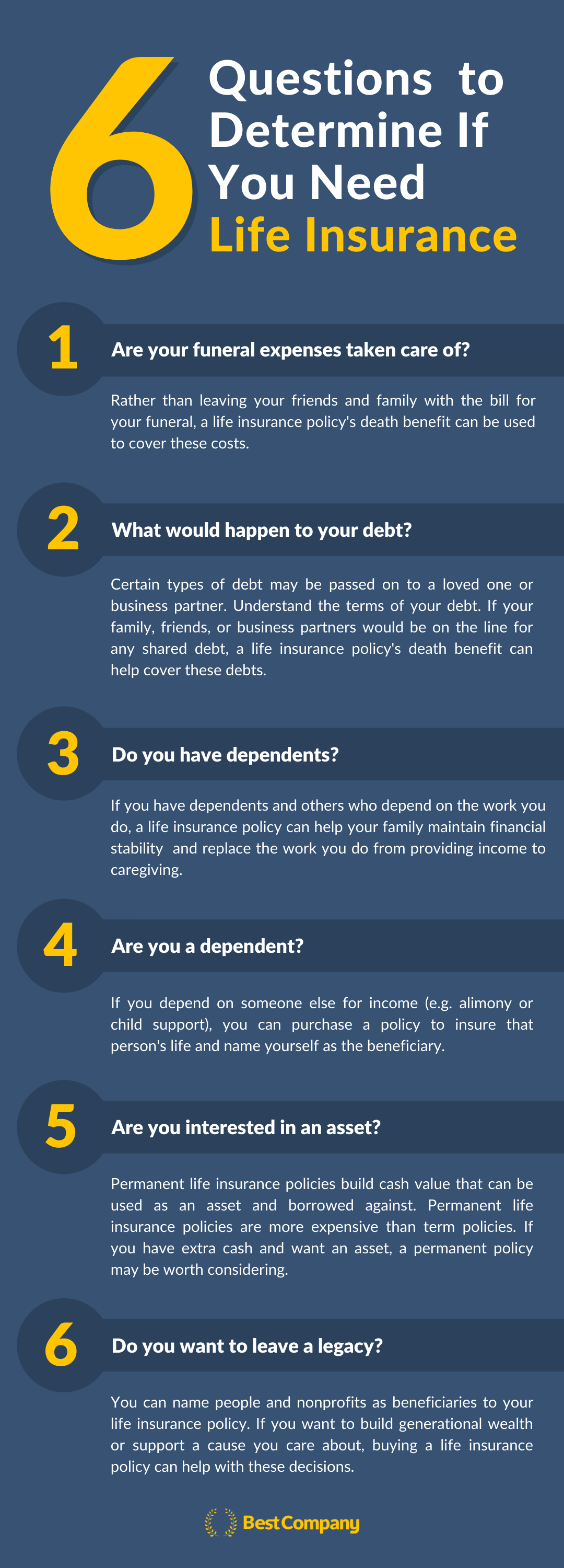

The more time it takes to open up a policy, the even more threat you encounter that an unexpected occasion could leave your family without protection or monetary assistance. Relying on where you go to in your life, it's vital to know specifically which kind of life insurance coverage is ideal for you or if you require any type of in all.

Some Known Incorrect Statements About The Wallace Insurance Agency

A house owner with 25 years continuing to be on their mortgage might take out a policy of the same length. Or let's claim you're 30 and strategy to have youngsters quickly. Because case, signing up for a 30-year policy would secure your premiums for the next 30 years.